lexington ky property tax search

Please enclose a check or money order payable to Fayette County Sheriff along with your tax bill coupon. Ad Find Anyones Lexington Property Ownership.

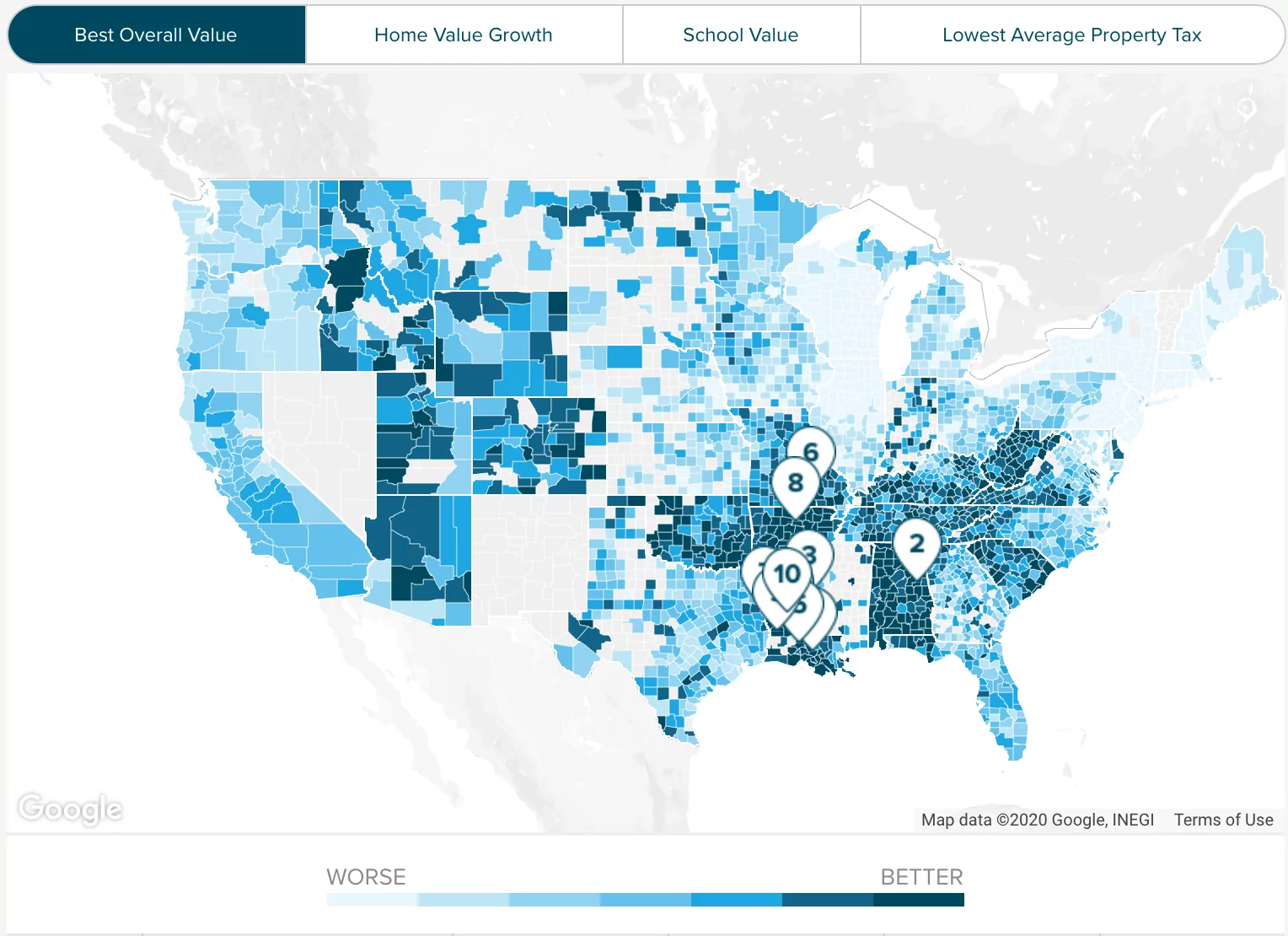

How To Find Tax Delinquent Properties In Your Area Rethority

You can find all information in detail on the PVAs website.

. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. Lexington Property Records Offices. On April 18 2022 the Fayette County Sheriff will turn over the unpaid tax bills to the County Clerks Office.

Property Tax Search - Tax Year 2020. Their phone number is 859 254-4941. The average price for real estate on Habersham Drive is 108772.

If you have questions regarding your assessment or exemptions please contact. The primary duties of the Assessors Office are to inventory all real estate parcels maintain the property tax mapping system and maintain property ownership records. Maintaining list of all tangible personal property Collecting.

Search Daviess County property tax and assessment records by name address or map including comparable sales search with free subscription. Current recording effective date is July 20 2022. The reader should not rely on the data provided herein for any reason.

Lexington Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Lexington Kentucky. Easily Find Property Tax Records Online. Adios Dr Lexington KY.

Lexington Permits 125 Lisle Industrial Avenue Lexington KY 40511 859-425-2255 Directions. Certain Tax Records are considered public record which means they are available to the. The assessment of property setting property tax rates and the billing and.

State Real Property Tax Rate. Property Tax Search - Tax Year 2021. 859 253-3344 Land Records Department.

For any taxpayers property that is assessed by the Department of Revenue and any Fee in Lieu of tax property the Others box needs to be searched using the taxpayers name. 859-252-1771 Fax 859-259-0973. Tax Records include property tax assessments property appraisals and income tax records.

Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein. Just Enter Your Zip for Free Instant Results. Allow up to 15 business days from the payment date to ensure bank.

State law - KRS 132020 2 - requires the State real property tax rate to be reduced anytime the statewide total of real property assessments exceeds the previous years assessment totals by more than 4. Finance Administration Cabinet. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation.

For information on these bills please contact the Fayette County Clerks Office at 859 253-3344. Limestone Ste 265 Lexington KY 40507 Tel. This website is a public resource of general information.

Maintaining list of all tangible personal property. Property Tax - Data Search. Lexington County implemented a countywide reassessment in 2015.

Lexington Code Enforcement 101 East Vine Street Lexington KY 40507 859-258-3270 Directions. It also adds and values new properties and conducts a reassessment of all properties every five years. Mayor Jim Gray today opened a new payment office to make it more convenient for.

Ann St Room 102 Owensboro KY 42303. The Fayette County Property Valuation Administrator is responsible for determining the taxable value of your property and any exemptions to which you may be entitled. If you cannot enclose a tax bill coupon please write the tax bill number account number and property address on your check or money order.

Each year the County Clerks Office is responsible for conducting a tax sale on the delinquent tax bills. Expert Results for Free. Office of the Fayette County Sheriff.

Apr 24 2017 1054 am. Public Property Records provide information on land homes and commercial properties in Lexington including titles property deeds mortgages property tax assessment records and other documents. Lexington establishes tax rates all within the states constitutional rules.

New LexServ office serves citizens. You may obtain. Ad Property Taxes Info.

Limestone Ste 265 Lexington KY 40507 Tel. Several government offices in Lexington and Kentucky state maintain Property Records which are a valuable tool for understanding the history of a. Search for owners names deed records property tax mortgage information and more.

Ad Just Enter your Zip Code for Property Tax Records in your Area. During the tax sale the delinquent tax bills are eligible to be purchased by a third party. As will be covered later appraising real estate billing and collecting payments conducting compliance tasks and resolving conflicts are all reserved for the county.

859-252-1771 Fax 859-259-0973. Only cash or check are accepted. The Property Valuation Administrators office is responsible for.

Payment posting may take 2-4 weeks from January 15th for some mailings and on-site drop box. We found 11 addresses and 11 properties on Habersham Drive in Lexington KY. STREET NAME OF PROPERTIES AVG.

Fayette County Kentucky Property Valuation Administrator Page overview The Property Valuation Administrators office is responsible for. Daviess County Property Valuation Administrator. Various sections will be devoted to major topics such as.

Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving customer service efficiency. Lexington Building Inspector 101 East Vine Street Lexington KY 40507 859-258-3770 Directions. Phone 270685-8474 Fax 270685-8493.

Discover the Registered Owner Estimated Land Value Mortgage Information.

918 Commanche Drive Property Real Estate Patio

161 Ginat Drive In Ground Pools Property Above Ground Pool

Delinquent Property Tax Department Of Revenue

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Property Valuation Notices Mailed Across Fayette County Ky Lexington Herald Leader

161 Ginat Drive In Ground Pools Property Above Ground Pool

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Buying First Home First Home Buyer Home Mortgage

Gertrude Pesch And Ingrid Kuhn At The Entrance To Noble Elementary School In Euclid Ohio Elementary Schools Elementary Euclid

Excel Mortgage Calculator Home Loan Calculator Spreadsheet Etsy Mortgage Loan Calculator Mortgage Payment Calculator Amortization Schedule

Shelby County Tennessee 1888 Map Shelby County Tennessee Map Tennessee

Excel Mortgage Calculator Home Loan Calculator Spreadsheet Etsy Mortgage Loan Calculator Mortgage Payment Calculator Amortization Schedule

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader

4037 Valley View Drive Pool Houses Valley View Large Family Rooms

2232 Pollard Road Real Estate House Styles Dream House

76 Sunnyside Drive Nicholasville Ky 40356 For Sale Re Max Http Www Remax Com Realestatehomesforsale 76 Sunnyside Drive Nichol Sunnyside Remax Home Buying